Quick, Clean, Accurate, and Easily Understandable Financial Reports – All by Using SAS!

The Obvious Importance

Money is the lifeblood of any business entity. We could not stress this enough. The very purpose and existence of any organization is the generation of more money.

Seeing how blatantly necessary it is for businesses to closely monitor their finances, it only makes sense that people would create certain methods or systems for doing so. How this is done will be further explained as you read on.

Choosing Between Manual or Automated

There are generally two ways for business owners, accounting staff or people in general to monitor their finances. Some prefer getting their hands busy and doing things manually while others prefer something that is automated or computerized.

We all have our preferences, but sometimes we think that at this digital age, many would be more inclined to use automated methods. However, there are still certain businesses that stick to manual accounting for a number of reasons.

Some say it is because the best way to learn how to do accounting is to do it manually and in a way that is true. Another reason may be because the business or company does not have enough funds yet to invest in an automated accounting system.

However, while manual accounting can be an effective learning curve and more affordable, it has a good number of disadvantages. A few examples of these are as specified below:

- Higher risk of inconsistent or inaccurate data entry

- It makes the accounting task something you can only assign to the most reliable of your staff, and you would become wary of leaving it with someone new

- It consumes a lot of time and involves a lot of paperwork

- Data entries have a high risk of being duplicated, thus rendering the financial report unreliable

- You would have to invest a lot of time in training staff to be suited for this job

- You might tend to allocate more staff than usual to accounting tasks to get everything done more quickly, thus sacrificing other operations or tasks

- Manual accounting is not as secure as you may think

That Is Why We Choose to Go Automated

We emphasized earlier how important it is to accurately and diligently keep track of your business’ financials and accounting. For that reason, it is only understandable that you would not want to risk that information becoming incorrectly or inaccurately tracked.

By simply adapting to an automated system for your accounting, you will be saving yourself from that risk. Right now you might be seriously thinking of going automated, but you might be wondering where you may be able to get a system that does just that.

The SAS or Synchronize Accounting System Software

To address the business’ need for a secure and accurate financial monitoring method, our team has developed an accounting software called the Synchronize Accounting System or SAS for short. To simply put it, SAS turns the messy and sometimes stressful task of financial monitoring into something that is a lot easier to do and a lot less stressful.

By using SAS, you can get accurate and easy-to-understand financial statements or reports by just inputting the right data and clicking a few buttons. There will be no need for you to go through mounds of paperwork gathering data, neither do you have to study all the helpful but sometimes confusing Excel Spreadsheets functions.

SAS helps you handle the recording and processing of all your accounting transactions, like your accounts receivable, cash disbursements, accounts payable, cash receipts, etc. To be a little more specific, here are a few instances where SAS can come in handy:

- Managing your vouchers, disbursements, and collections

- Creating your general ledger reports and financial statements

- Monitoring your receivable and payable accounts

More of What Is Inside SAS

Here is a more detailed list of what features and functions are in the Synchronize Accounting System:

Client

- Client Setup

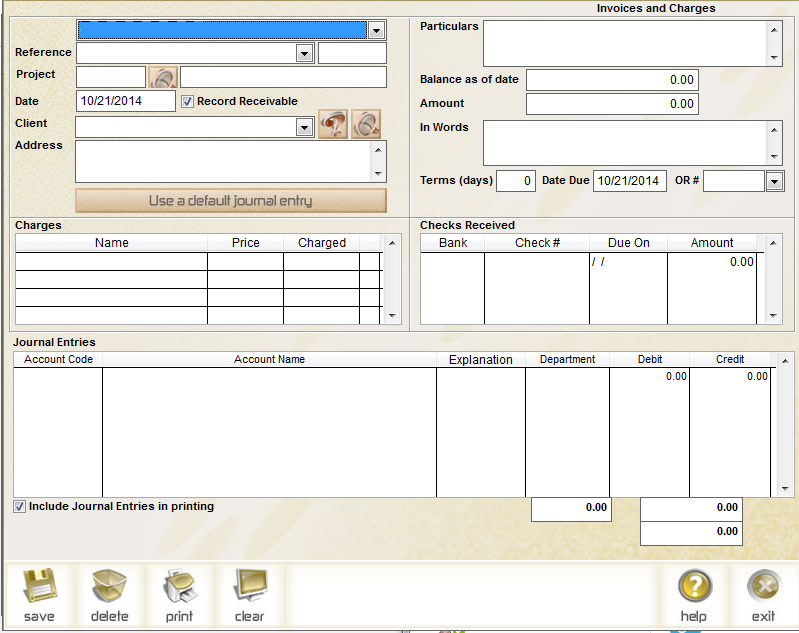

- Charges and Invoices

- Payments and Cash Receipts

- Balances, Ledger, and Statement of Accounts

- Aging of Receivable Accounts

- Receivable Schedule

Supplier

- Supplier Setup

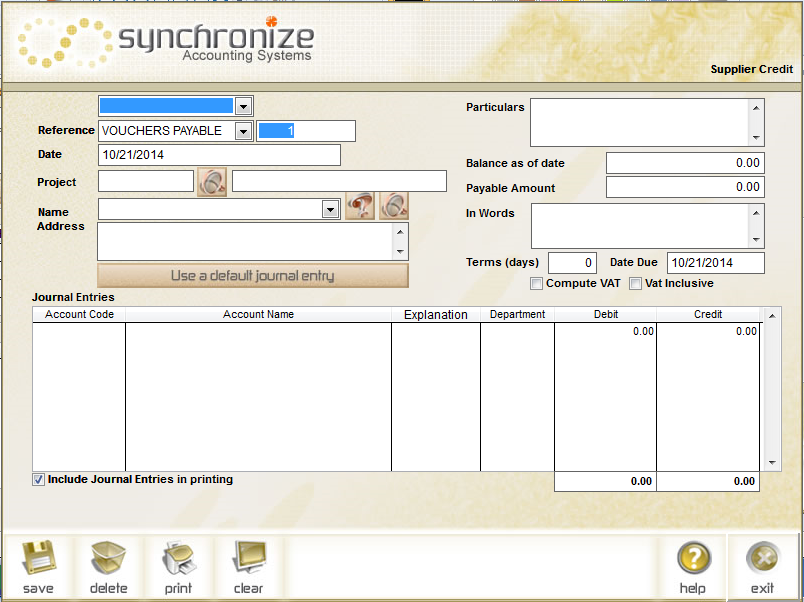

- Charges and Credits

- Cash Disbursements and Debits

- Balance and Ledger

- Aging of Payable Accounts

- Payable Schedule

Setup

- Company Setup

- Department/Division Setup

- Reference Setup

- Chart of Accounts

- Default Journal Entries

- Default Report Header

- Budget Setup

- Bank Setup

Reports

- General Ledger and Account Schedule

- Voucher/Invoice Summary

- Journalized Transaction Summary

- Financial Statement (Balance Sheet, Statement of Profit and Loss)

- Department Expenses Monitoring

- Budget Monitoring

- Check Report

- Cash and Checks Collection Summary

What SAS Looks Like

To give you a more visual illustration of SAS, here are a few screenshots of the software itself!

Homepage:

Where you can view your list of reports:

Create and edit invoices and charges:

Create and edit payable charges and credits:

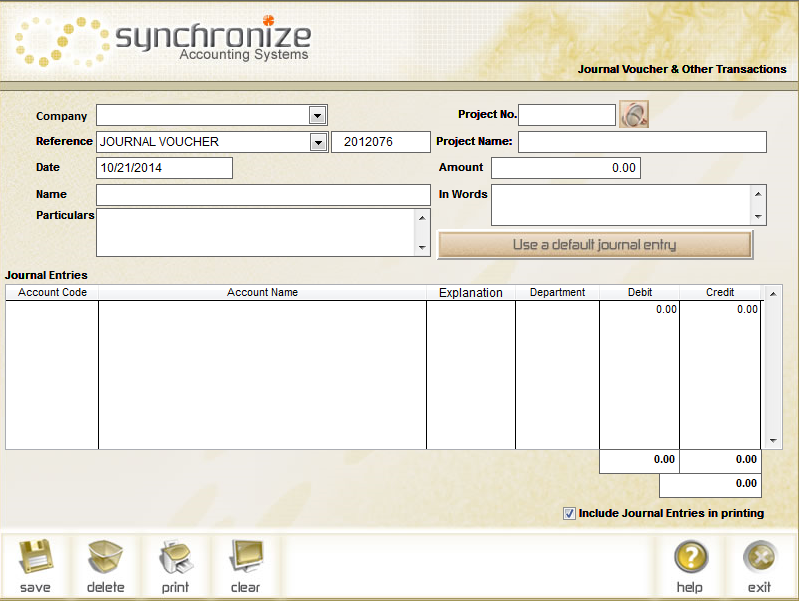

Input other transactions for monitoring purposes:

How You and Your Business can benefit from SAS

Using our Synchronize Accounting System for your financial monitoring will mainly take a big load off your shoulders. This load we are talking about is the one that is usually put there by the tedious financial monitoring.

Apart from that, though, here are more benefits you and your business can gain from using SAS:

- Easy to use – you do not have to be a tech wiz to get the hang of SAS; besides we will be providing you and your staff with the appropriate training in using our software

- Increase staff productivity – your staff can spend just a matter of minutes inputting data on the software and SAS will do most of the work for them. This is more efficient than having them spend hours on end manually typing data and calculating everything. This allows them to become more open to doing other tasks that may help not just them, but for your business to become more productive.

- Improves data accuracy – sometimes looking at an Excel spreadsheet full of numbers can leave one blind to any potential errors it may have. SAS has a neat, clean design where you only need to type in certain kind of data, and it will generate reports, making them easier and more accurate.

- Reduce audit expenses as records are neat, up-to-date, and accurate – since you run a lower risk of inaccurate data, you also run a lower risk of potential unnecessary expenses!

Contact Us to Get Your Own SAS!

Tidy up your financial monitoring and speed things up without having to sacrifice quality and accuracy! Contact our sales executive to get your hands on your own Synchronize Accounting Systems.

Comment 0